Robert Half Salary Guide: 57% of New Zealand CFOs plan to increase salaries for existing finance and accounting employees.

According to the 2016 Robert Half Salary Guide, there is good news on the horizon for existing employees in finance and accounting teams as more than half (57%) of New Zealand CFOs and finance directors say they are looking to increase salaries of their finance and accounting employees over the next 12 months.

There is also some good news for candidates looking for a new role. On average, starting salaries for finance professionals are expected to rise by 2.4% in 2016. Several specialist finance roles can therefore expect an increase in starting salaries in 2016.

What are the 5 golden finance jobs?

The top year-over-year increases in terms of starting salaries will go to:

- Accounts Payable Clerks (5%)

- Financial Accountants (4%)

- Financial Controllers (4%)

- Internal Auditors (4%)

- Payroll Managers (4%)

“Pay rises for several ‘golden’ in-demand and hard-to-fill roles reflect high levels of confidence and a supportive business environment in New Zealand,” says Megan Alexander General Manager Robert Half New Zealand.

“Top candidates, who possess much sought or hard-to-find skills, regularly receive multiple job offers and are in a strong position to negotiate starting salary. Companies know competitive remuneration packages are essential to bring in the necessary talent.”

Comfortably double the rate of inflation, these rises will not however be enjoyed by everyone, with starting salaries remaining stable or only increasing marginally across the majority of finance and accounting roles. For roles such as CFOs, Credit Managers, Financial Controllers and (Assistant) Accountants, starting salaries will stay stable or increase only marginally.

Also, more than two out of five (41%) New Zealand companies plan to apply a stable remuneration policy for their existing finance and accounting employees, meaning they will keep salaries on hold in 2016.

Megan Alexander says: “Even though there are several professionals who can expect a pay rise, many other positions will not or only see a marginal increase. Although companies understand the importance of offering a competitive salary, not all companies rely on pay rises. Others rely on their brand, pay extra attention to work-life balance, or offer appealing career opportunities to attract and retain top talent.”

Remuneration packages are about more than salary

Even though offering a competitive base salary is essential when it comes to attracting quality professionals, non-cash benefits are also highly valued by candidates. This opens up the playing field to businesses whose budgets don’t extend to top tier salaries in their industry.

“For the overwhelming majority of companies, benefits in addition to salary are now part of the standard pay package. There is especially a greater drive among candidates to achieve a better work-life balance through flexible work hours or telecommuting. This has allowed for the emergence of the flexible workplace,” says Megan Alexander.

Australian and New Zealand businesses are expanding but there are some trans-Tasman differences

Both sides of the Tasman are confident about the year ahead, with 51% of Australian and 42% of New Zealand businesses expanding and adding new finance positions. But there are some key differences in the drivers behind recruitment and remuneration across the ditch.

Demand for qualified finance professionals continues to grow.

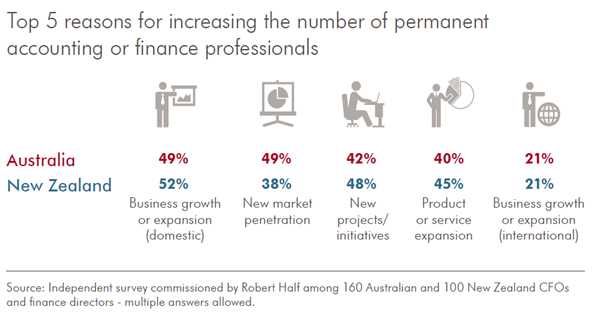

The increase in the number of permanent accounting or finance professionals in Australia is equally driven by business growth and new market penetration (49%). In New Zealand business growth and expansion is the biggest reason (52%) followed by new projects and initiatives (48%).

New Zealand businesses are struggling to find skilled workers

The ‘War for Talent’ continues into 2016, as business leaders are faced with the twin challenge of a specialist skills shortage and retaining top professionals.

As technology and the business environment become more complex, companies are looking for talent with specialised skills.

But achieving the right mix of skills is not always without challenges. Almost nine in ten (88%) New Zealand CFOs and financial directors find it challenging to source skilled finance professionals.

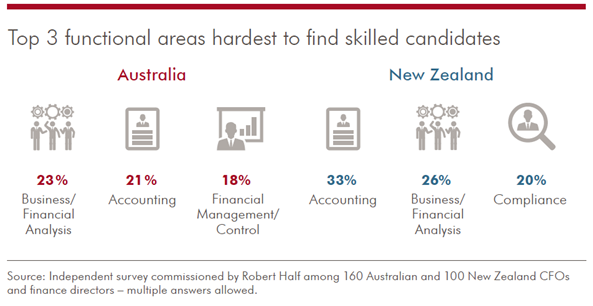

The top three areas hardest to find skilled candidates in New Zealand are accounting, business/financial analysis and compliance. Companies are looking for professionals with a proven track record, an outstanding business acumen and the ability to add value to the company’s success. Moreover, organisations are seeking professionals with a specific expertise. In addition, soft skills are increasingly regarded as”need-to-have” competencies.

“With so many New Zealand CFOs saying it’s challenging to find qualified finance professionals, those in possession of the much sought-after and niche skills are ahead of the competition to secure the best salary offers,” says Megan Alexander.

“Tight timeframes are also becoming essential in today’s recruiting environment with many organisations increasingly making an offer within 48 hours of interviewing candidates in order to secure top talent.”

##

About the Robert Half Salary Guide

The 2016 Robert Half Salary Guide is the most comprehensive and authoritative resource on starting salaries and recruitment trends in finance and accounting in New Zealand.

It offers a comprehensive overview of the current salary ranges, non-financial benefits and specific job trends for finance and accounting professionals. The results and insights of the 2016 Robert Half Salary Guide are based on comprehensive analysis, local expertise and independent research of executives and office workers.

About the research

The annual study is developed by Robert Half and was conducted in December 2015 by an independent research firm, surveying 100 Chief Financial Officers (CFO) and finance directors in New Zealand. This survey is part of the international workplace survey, a questionnaire about job trends, talent management and trends in the workplace.

MEDIA CONTACT

Katherine Mills

Public Relations Manager, Asia Pacific

P: +61 2 8028 7757

E: [email protected]